- Erica Williams, Chair of the PCAOB, on the introduction of new QC standards

Public accounting regulators have recently taken a special interest in the role of technology in the quality of audit processes. Following the International Ethics Standards Board for Accountants (IESBA) implementation of a new standard for a system of quality management last year (ISQM-1), the PCAOB also proposed a new quality control standard QC-1000.

QC-1000 would overhaul the current quality control standards of the PCAOB, which are over 20 years old. The environment audit firms operate in has changed significantly over this time period. The current standards are showing their age because they do not adequately address the advances the industry and the world as a whole has seen with technology and data. With modern technology systems and reliance on data, regulators like the PCAOB are able to set higher reasonable expectations for auditors to meet.

As the PCAOB summarizes, QC-1000 seeks to:

With a 394 page document, many details are not summarized well in six bullets. For instance, page 313 changes the standard for personal financial interest system tracking

The firm’s policies and procedures for matters that may reasonably be thought to bear

on the independence of the firm, firm personnel, and affiliates of the firm (see paragraph .33a.) must include:a. Identifying firm and personal relationships and arrangements with restricted

entities, including a process for identifying direct or material indirect financial

interests that might impair the firm’s independence of firm personnel that are

managerial employees or partners, shareholders, members, or other principals.(1) If the firm issued audit reports with respect to more than 100 issuers during the

prior calendar year, such process should be automated.

This proposed standard, should it be approved, would require an automated system for financial interest disclosure for firms that audit over 100 public companies. With a new regulatory line in the sand for financial interest tracking - many firms are prioritizing the question...

Firms that are not required to maintain a financial interest tracking system today now need to respond by deciding on one of these three options:

Option 1 may be a strategic shift for a firm if the long-term plan is to move entirely out of the public company audit business. We are beginning to see a trend of some smaller to mid-size firms going this direction in order to avoid a new business system and reduce their total cost of compliance. Regardless of the reasoning behind a firm choosing this option, the issuer audit limit will be an ongoing regulatory risk to monitor.

Option 2 is effective if the firm has the proper resources to commit to building and maintaining a new system in-house. The table below breaks down the high level resources to consider for an in-house system implementation:

| Resource | Considerations |

| People | Success is dependent on the expertise of the people involved and the clarity of what success means from an early point in planning. Staffing needs to be considered not only for the implementation but also for ongoing upgrades and maintenance. |

| Time | Firms should expect 24-36 months of calendar time to develop and launch an in-house system, based on The Standish Group's research and CHAOS report. |

| Budget | Firms will spend tens of millions of dollars to develop systems comparable to Kingland's enterprise software. As in-house implementation completes, costs plummet as hosting and maintenance become the sole expenditures. However, costs will again accelerate beyond what is commonly charged by vendors in 2-3 years time as upgrades to security, functionality, and underlying technologies are required. |

This option is attractive to some firms because the resulting system can be designed to fit requirements exactly, however the technical expertise to develop and maintain software is not where it should be. As we identify in our case study of software development costs, the risk remains high that costs will go over budget, and deadlines will extend beyond initial expectations. Click here to read the case study.

Option 3 has many accounting firms already in compliance when QC-1000 goes into effect. They work with Kingland. By selecting Kingland, firms and global networks reach compliance with regulations like QC-1000 quickly - from contracting to production environments being available in 6-9 months.

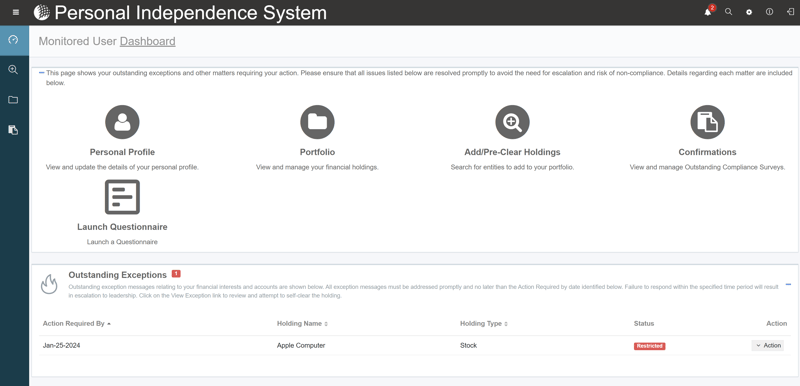

Kingland's Personal Independence software provides dozens of capabilities that automate personal independence compliance for firms today. Directors, partners, and teams are able to manage their independence from their laptops and on mobile with iOS and Android native app support. Trusted by many of the largest public accounting firms and global networks, Personal Independence helps firms improve compliance rates, support accurate employee financial disclosure, and reduce manual processes.

We collaborate with you to tailor Personal Independence for your needs - selecting and configuring the capabilities you need today. The system is uniquely yours, with page content, questions, and permissions determined by your administrators. In the background, cloud-optimized software scales to your usage over time to provide performance for only what your firm needs.

If your firm is interested in implementing Personal Independence for yourselves, reach out to me at colin.ward@kingland.com or use the link below.

These Stories on Public Accounting

No Comments Yet

Let us know what you think